In brief: Although Bitcoin's price is up 74% since the start of 2023, the overall crypto market isn't looking too healthy compared to last year. According to exchange giant Coinbase's latest earnings report, transaction volume for consumers in Q2 was down by 70% year-on-year, while the figure for institutions fell 54%.

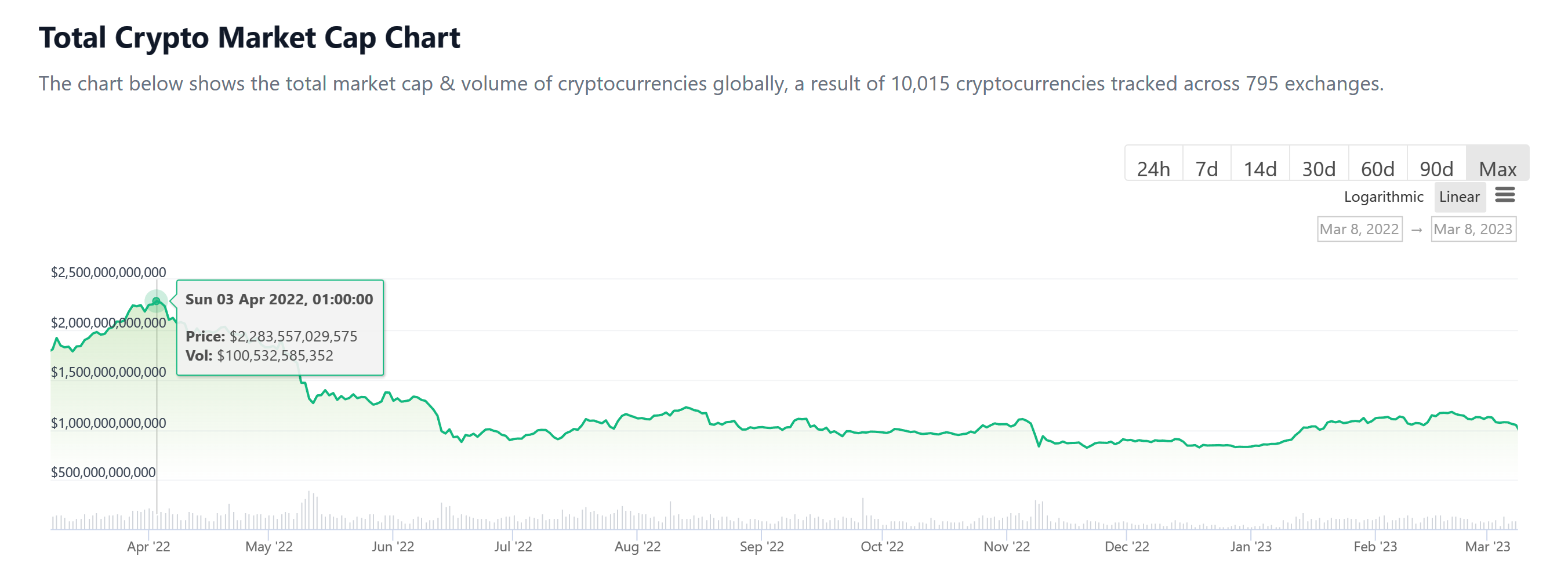

Coinbase says the massive drop in transaction volume is due to crypto's overall market cap decreasing year-on-year. On April 4, 2022, the market cap was $2.26 trillion. But falling average crypto prices saw it drop to under $1 trillion at the start of 2023.

The low volatility of crypto prices has also had an effect. Many coins have seen little change in their prices following an increase during the first three months of the year. It means there have been fewer opportunities to make a profit from buying low and selling high.

Bitcoin started 2022 at around $47,000 – far from its peak of $68,789 a few months earlier, but anyone who bought some BTC for $10,000 in 2020 was still happy. However, last year brought the so-called crypto winter. TerraUSD and support coin Luna crashed in May, wiping almost $1 trillion off the crypto markets. Celsius, Three Arrows Capital, and Voyager Digital all collapsed, and then the messy FTX implosion helped bring the market's total losses to over $2 trillion.

While BTC's current $29,000 price is a lot higher than the $16,605 it was in January, the world's most popular digital coin has stagnated since March, and the industry is still facing problems – one tech billionaire said "Crypto is dead in America" in April. We've also heard of cryptominers pivoting GPU farms to AI workloads following the price declines.

The SEC filed a lawsuit against Coinbase and Binance in June alleging that, among other things, tokens on the platforms are unregistered securities. Coinbase argued to have the case dismissed on Friday, claiming that it does not sell unregistered securities through its staking-as-a-service program.

One bright spot for the crypto market could be AI CEO Sam Altman's Worldcoin. The crypto network, which uses an iris-scanning identification system, has raised $100 million and recently expanded globally, but not in the US due to regulators in the country increasing their scrutiny of all things crypto.

The falling crypto market has also had an impact on non-fungible tokens. The famous NFT showing the first-ever tweet - from then-CEO Jack Dorsey - that cost $2.9 million in 2021 went up for auction recently. The highest bid it received was $2,199.