The big picture: Recent PC hardware market reports have been uniformly pessimistic for the first quarter of the year as the industry continues its post-pandemic hangover, and discrete desktop GPUs are no exception. However, the sector could follow other areas into a slow recovery, starting in the second half of 2023.

According to Jon Peddie Research, unit shipments of new add-in-boards (AIB) – essentially dedicated desktop graphics cards – declined 12.6 percent from the previous quarter and 38.2 percent compared to Q1 2022. Any recovery later in the year may depend on recently-released mainstream GPUs from AMD and Nvidia.

Team Green suffered the largest quarter-on-quarter slide, with a 15.2 percent drop in shipments. Meanwhile, AMD suffered a 7.5 percent decrease.

The numbers echo recent reports from other PC sectors indicating consumers are no longer rushing to upgrade their hardware like in 2021. Analysts also attribute the downturn to layoffs and anxiety over inflation, which are related to broader fears of an approaching recession. Furthermore, despite last year's new releases from the RTX 40 and RX 7000 series, many customers may have decided that last-generation GPUs are good enough.

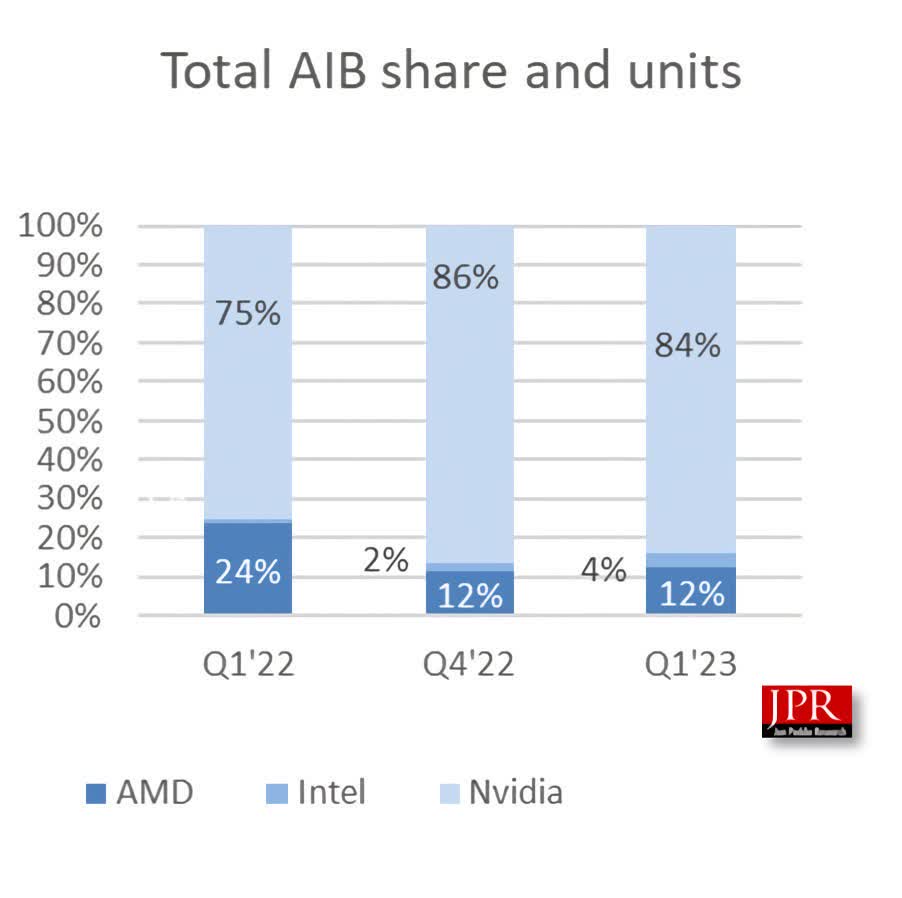

Despite the sales slump, the market share between the three GPU competitors changed little from the preceding quarter. Team Red maintained its 12 percent hold on the discrete desktop graphics sector, while Intel slightly cut into Nvidia's share. However, the new player still only has a four percent toehold in the market, while Team Green retains a dominant 84 percent. The year-over-year shift is more dramatic, with AMD having lost half its market share.

With inventories dropping, Dr. Jon Peddie predicts new shipments to start picking up in Q3, with the second quarter usually being a slower period. However, the market response to the latest products has yet to fully play out.

Nvidia and AMD launched their latest mid-range graphics cards last month to a generally lukewarm reception from critics. Although Team Green's xx60-tier GPUs are usually its most popular, the new GeForce RTX 4060 and 4060 Ti are currently facing backlash for only offering 8GB of VRAM for $400. Although the red team's competing RX 7600 is significantly cheaper at $270, its performance is still disappointing compared to its predecessors.

Looking further ahead, other analysts expect the fourth quarter of this year to show an improvement for all PC hardware, leading to market growth throughout 2024. PC gaming hardware should see a recovery through 2025.