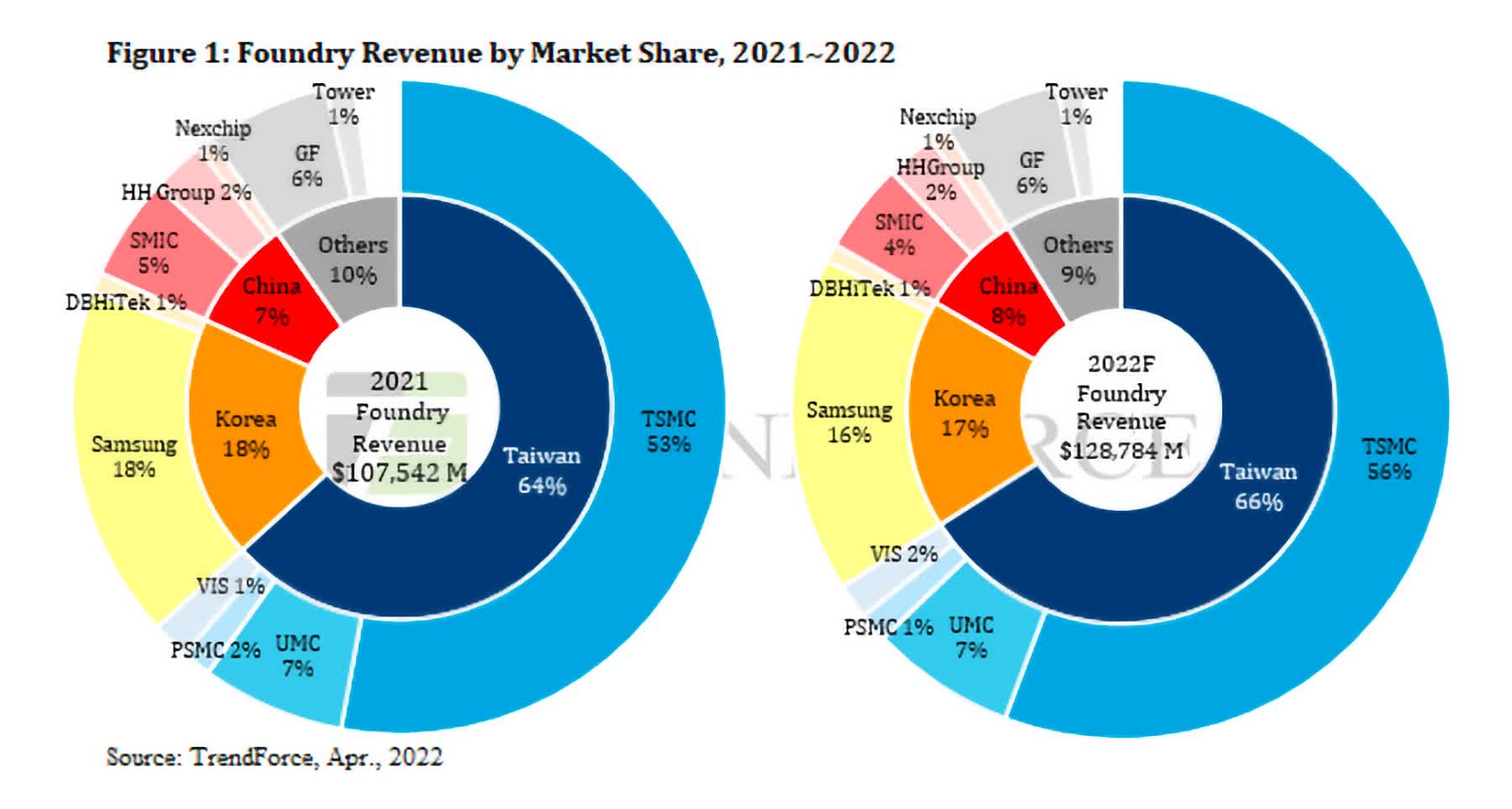

There is only one company operating at the leading edge of semiconductor manufacturing and that is TSMC. Many will read that and think "Of course, that's obvious," but we mean that in a very specific way (many more will read that and then go back to swiping videos on TikTok, so thank you for sticking around...).

For the past few years, there have actually been two companies operating at the leading edge – TSMC and Samsung. With all the attention that TSMC gets for both commercial and geopolitical reasons, we found that a lot of people sort of forgot about Samsung. A few years ago that would be a mistake, Samsung was always competitive with TSMC, if a little bit slower and harder to work with. But it is looks like that may change.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

As usual, Dylan Patel has a good piece on the troubles at Samsung. The quick summary of that piece is that Samsung is facing delays both for its 7nm process and for its DRAM memory products. Read back on some of the press coverage of Samsung over the past year, and it looks a lot like something is really wrong there. Delays. False starts. Mixed messaging. For us, the eeriest part of this is that this is a pattern we have seen many times before. This is what every company looks like just before they fall off the Moore's Law curve.

To be clear, we are not saying that Samsung is going to abandon development of leading edge manufacturing capabilities. They have immense resources and know-how. They have to keep moving forward. But that does not mean they have to structure their business the same way.

More specifically, we have heard a few people argue that Samsung should exit the foundry business, stop manufacturing chips for others and instead focus solely on their highly profitable memory business. We know that there are people within Samsung making this argument, but we have no way to gauge how influential they will ultimately be.

This is why it so important to remember Samsung in discussions about foundries. They have provided an alternative to TSMC for years, but there is a non-zero chance that they may no longer provide that alternative. Again, we are not saying this is going to happen, but in all our discussions about supply chain resiliency it is important to remember that things could actually get worse.

What would that look like?

Here the answer depends a lot on which customer we are talking about. Many of the largest chip companies – notably Nvidia and AMD – have long ago moved away from Samsung for the most part and dedicated themselves to TSMC.

They made large order commitments, a process which is now haunting their results. At the other end of the spectrum, almost every small startup chip company we know has never considered working with anyone other than TSMC for the leading edge.

Samsung's foundry business is not easy to work with for small companies, customer service is not their key selling point. Those companies are already living in a world where TSMC is the only option, and they are paying full price for that, with another 20% bump coming soon. That leaves a large group in the middle, Samsung foundry reportedly has over 100 customers, of which Qualcomm is the largest. Even though most of those companies likely work with TSMC as well, losing Samsung as a foundry would cause a lot of pain. This would likely mean product delays and meaningful cost increases – a.k.a. disruption.

None of this is set in stone. A lot could change. Samsung could make the organizational changes it needs to unstick their manufacturing process improvements. They could get subsidies from the Korean and US governments to "encourage" their remaining around.

Further out, Intel could conceivably turn around its manufacturing and then figure out customer service. But after two years of everyone being constantly surprised to find out how brittle the semis supply chain is, now is a good time for the industry to start doing some scenario analysis and contingency planning.