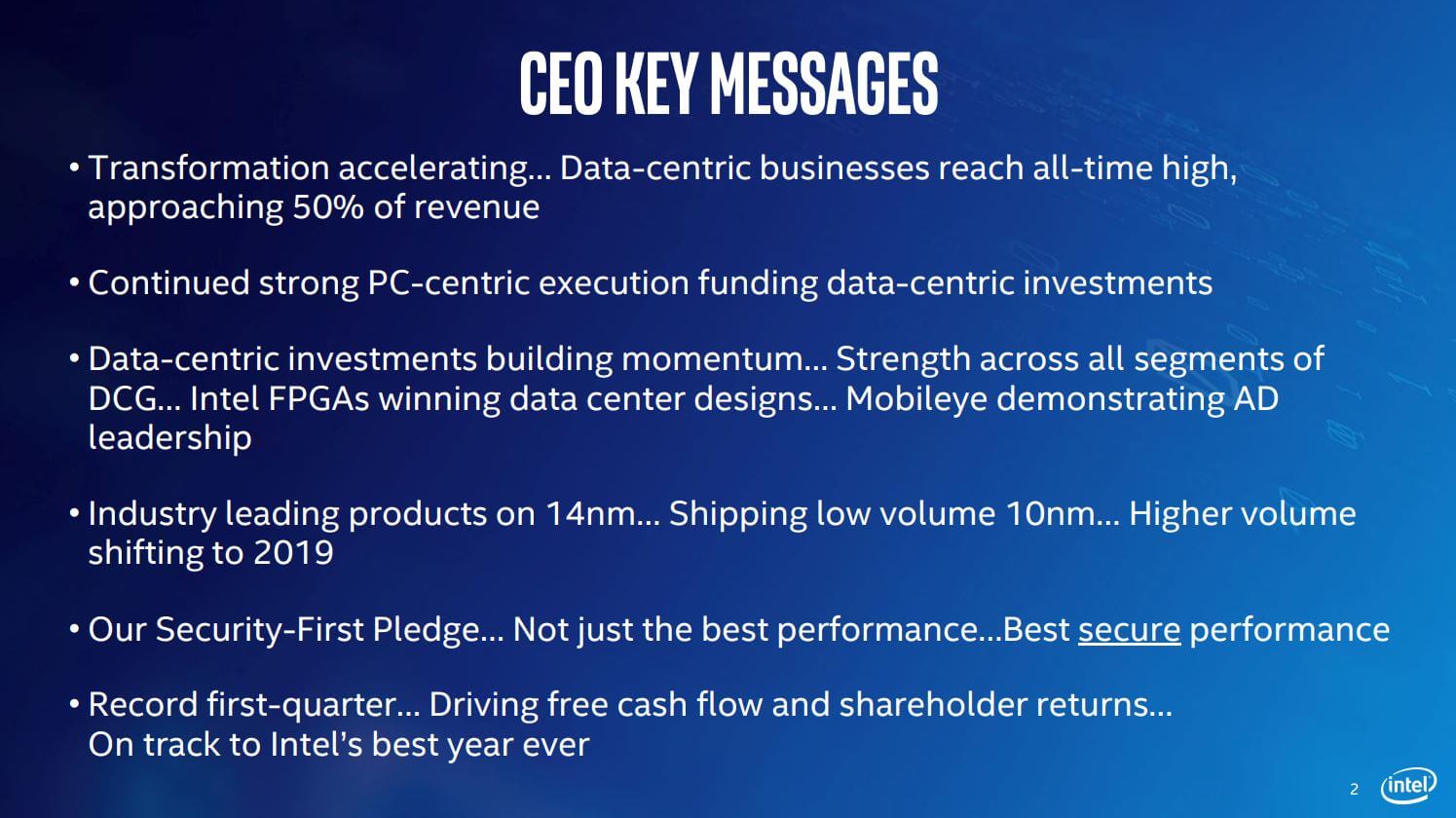

As first quarter financial results are made available, Intel's CEO has shared some insight on future production plans. Processors built on the 10nm process may be in short supply this year since mass production is being pushed back into 2019.

The cause of the delay is still unknown but it is safe to say that creating transistors made of only a few dozen atoms is difficult. AMD has proven that 12nm mass production is alive and well with its second generation of Ryzen chips from GlobalFoundries but even relatively small die shrinks introduce a number of technical challenges.

AMD will hold the edge in process technology throughout most of this year and is intending to make the jump from 12nm all the way down to 7nm. CEO Dr. Lisa Su revealed that Radeon Instinct, a GPU optimized for machine learning built with a 7nm process, is already being tested in labs.

Even though Intel had a profitable first quarter this year and reasonable growth, the consumer market did little to contribute to growth of earnings in comparison to income fueled by data centers. Sales for consumer notebooks, desktops and modems rose three percent. Intel's data center group grew about 75 percent from cloud computing.

Overall, Intel is still very clearly ahead of AMD in terms of revenue despite the red team posting impressive quarterly figures. Intel is predicted to pull in $67.5 billion while AMD pales in comparison at a mere $6 billion. However, more market segments to handle also means less attention given to specific products and niche areas.