The speculative nature of cryptocurrencies has caught the attention of gamblers and investors alike in hopes of chasing elusive quick cash. Aside from causing a shortage of graphics cards, using mass amounts of power globally, and making it difficult to track criminals online, the danger of speculation still remains. Congress may make it much more difficult to engage in speculative cryptocurrency trading.

One of the main reasons that Congress is taking a closer look at cryptocurrency is due to the adverse effects that speculation can lead to. Much like Black Thursday in 1929, consumers are putting a lot of money into assets that are expected to rise in value, but have no backing. There have been many massive rises and falls among all major digital currencies, but there is no safeguard in place to prevent a flash crash.

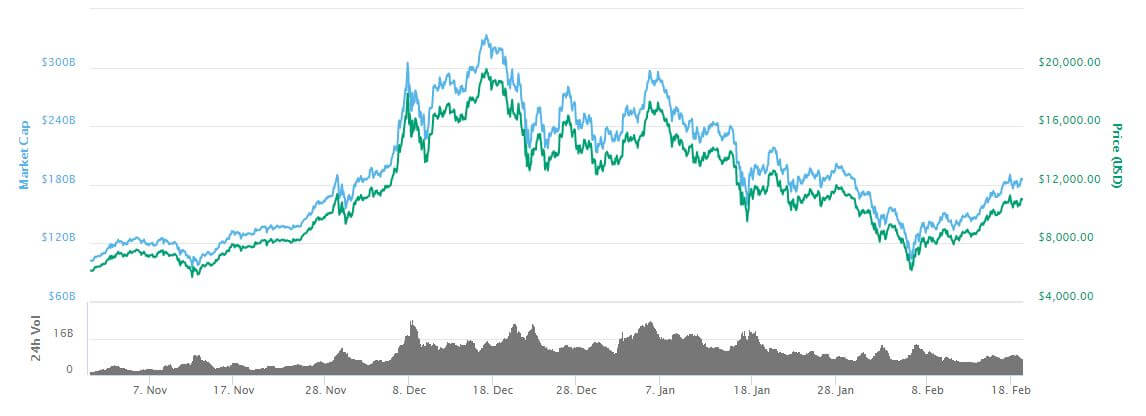

Most recently, Bitcoin took a tumble from its high of almost $20,000 all the way down to the $6,000 range. Over $200 billion of market value was eliminated between December 17, 2017 and February 6, 2018. Due to the common swings in value, Congress is concerned that consumers could be risking more than they are aware of.

Over the next several weeks, hearings will be held by the House Financial Services Subcommittee on Capital Markets. Committee Chairman Bill Huizenga says that "the marketplace has changed," now that there has been such extreme growth over a short time period.

In addition to the risks of speculation and ever changing values, hacks of exchange sites are a large problem as well. There have been billions of dollars stolen from exchanges over the past five years with little recourse for users of sites that have been hacked. So far, government interaction with cryptocurrencies has been slow and not very restrictive. One of the most influential decisions has been the crackdown on initial coin offerings by the SEC to attempt to prevent fraud and funding of malicious organizations.

According to Senator Chris Van Hollen of the Senate Banking Committee, "the goal here is to have rules of the road that protect consumers without trying to squash innovation." This stance shows that it is understood that blockchain technology has uses far beyond just trading and speculation. Digital currencies themselves are likely to change and continue to evolve just as the rules and regulations surrounding them are created.