In brief: Chinese companies are getting ready for more import restrictions from the US, the Netherlands, and Japan by stockpiling chipmaking equipment, components, spare parts, and materials. Sources say some firms have filled several warehouses with items in preparation for additional sanctions.

Last month brought news that the Netherlands and Japan had reached an agreement with the US to impose restrictions on the export of advanced chip-manufacturing tools to China, though the sensitivity of the deal meant details have not been announced.

The South China Morning Post reports that news of the agreement has seen China's biggest semiconductor firms racing to stockpile chipmaking gear in preparation for more restrictions on advanced equipment. According to a source involved in the industry's supply chain, one Beijing firm "filled several large warehouses" with materials and components. Some of the items are not even on the US export control list.

An unnamed Tokyo source who purchases Japanese products for Chinese customers confirmed some companies are overbuying components and equipment over fears of tighter export restrictions down the road - this is despite Tokyo not starting the process yet. Japanese companies are waiting for guidance on the new rules, which are expected to come into effect this April.

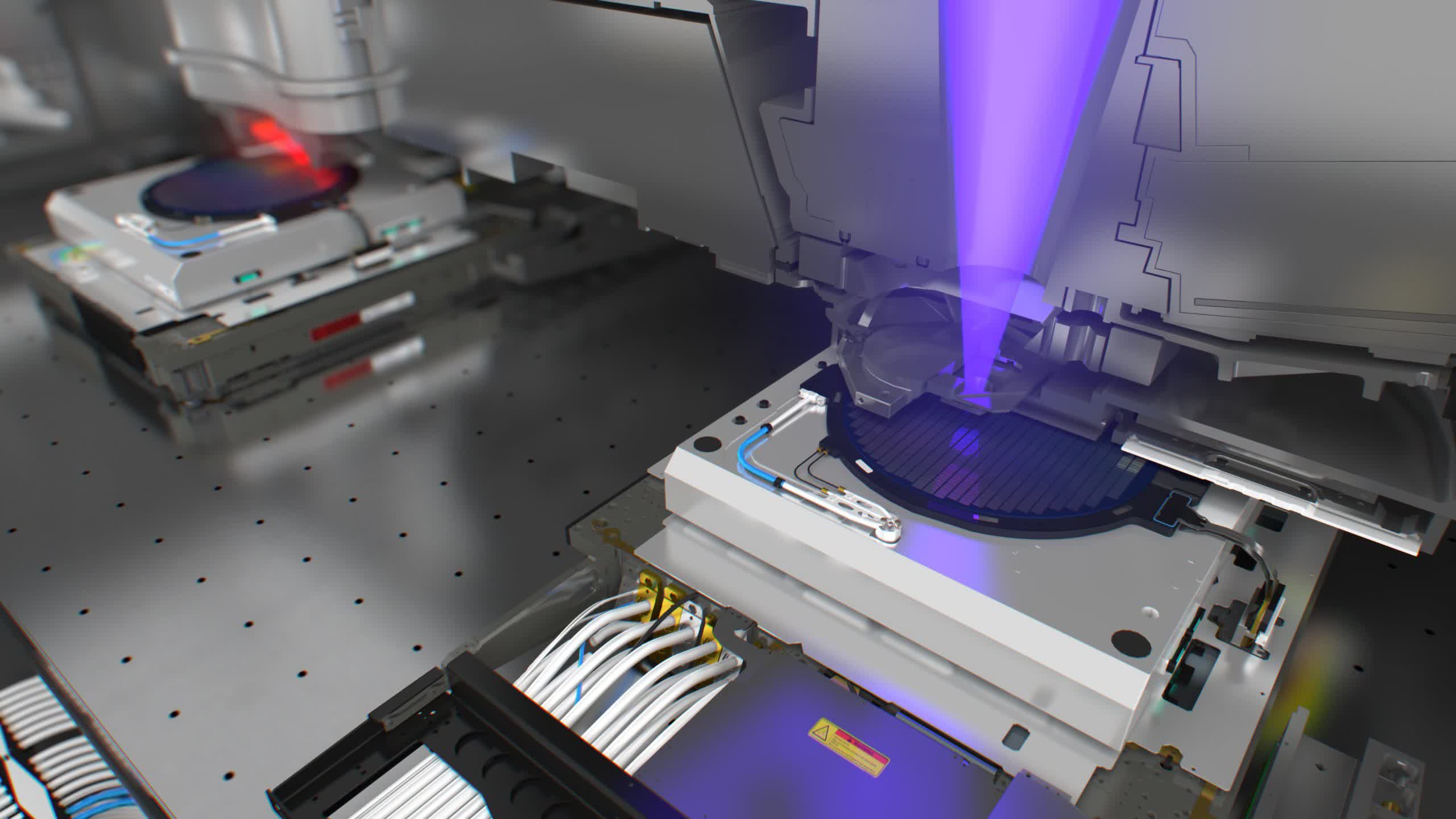

Dutch giant ASML, the world's largest supplier of lithography machines used in the chipmaking process, was already prohibited from selling its most advanced extreme ultraviolet (EUV) lithography equipment, which costs about $164 million per unit, to Chinese customers as it cannot obtain an export license from the Dutch government due to pressure from the United States. Following the three-nation agreement, ASML is also prohibited from selling at least some of its older deep ultraviolet (DUV) lithography tools to Chinese clients.

The US has tightened chip-related sanctions on China over the last 12 months. Restrictions introduced in October are designed to cap the country's logic chips at the 14-nanometre node, DRAM at 18nm, and 3D NAND flash at 128 layers. The US says this will prevent its rival from developing semiconductors for military applications, including supercomputers, nuclear weapons modeling, and hypersonic weapons. The restrictions are also having a major impact on the Made in China 2025 plan for lessening the nation's reliance on foreign chipmakers.