TL;DR: TMSC may reverse its decision to charge more for its most advanced silicon wafers. As the company faces an early 2023 revenue dip, it may try to lure more chip manufacturers onto its latest node processes with more aggressive pricing.

Sources have told MyDrivers that TSMC could lower the prices of 3nm chips to entice more manufacturing partners. The cut would apply to all of the company's 3nm processes, not just the inaugural N3.

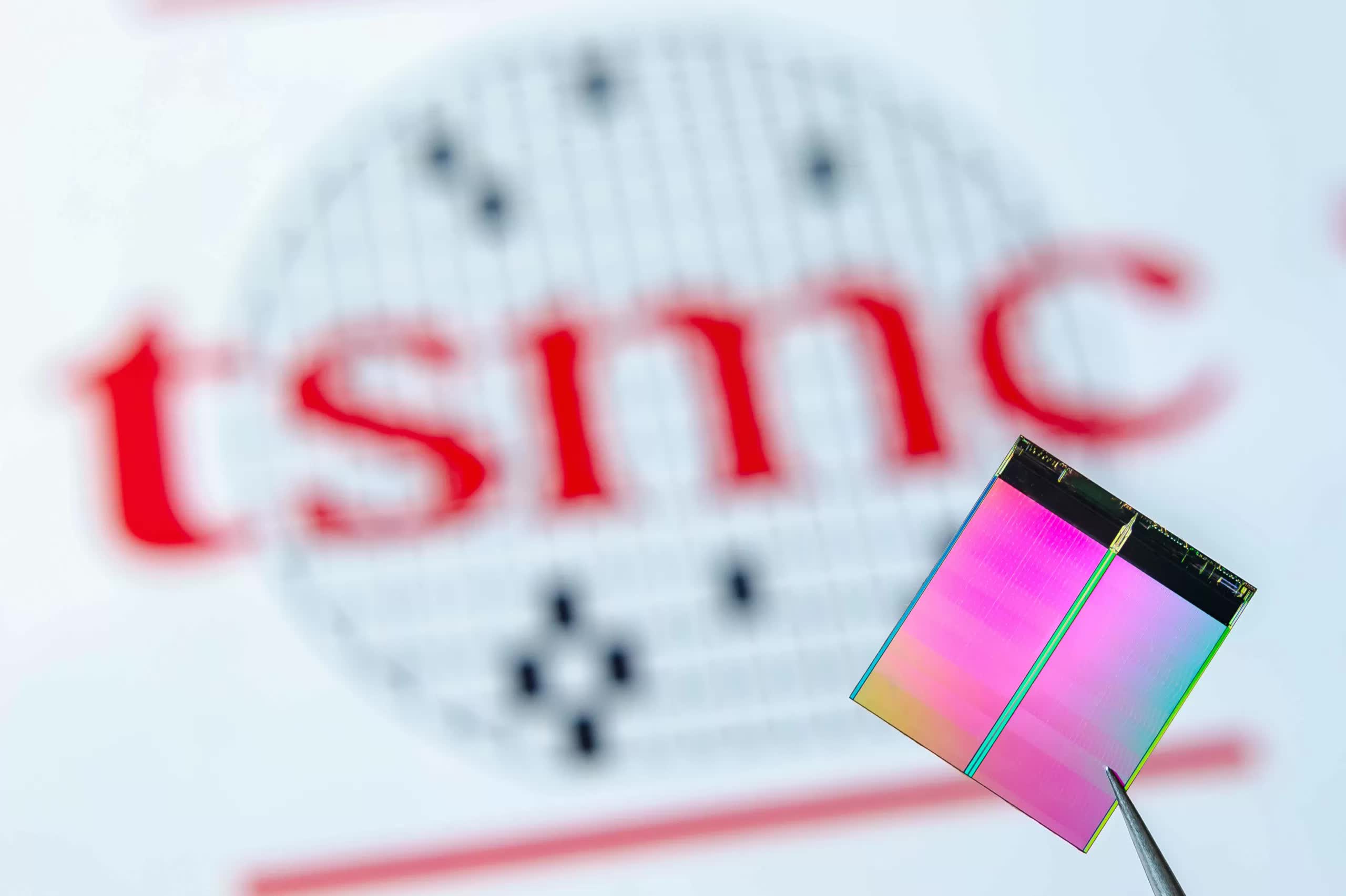

Last November, DigiTimes reported that TSMC planned to charge $20,000 per 3nm wafer - a 25 percent hike over 5nm because of the extensive EUV lithography process involved in manufacturing. Apple accepted the price increase to secure 3nm chips for its upcoming iPhone 15, but it seems other companies like AMD, Nvidia, Qualcomm, and MediaTek backed off for the time being. Apple is TSMC's main customer for N3.

The Taiwan-based company started mass-producing N3, its first 3nm process node, at the end of 2022. The more stable and efficient N3E node is expected to follow later in 2023 and may be less expensive to produce. That might enable TSMC to lower prices, but they could also cut the price of N3 if they wanted to drive larger volumes.

AMD is expected to use a 3nm process for its upcoming Zen 5 CPU architecture, which first emerged in a May 2021 leak. It's unclear when AMD might officially unveil Zen 5. Nvidia could utilize 3nm for its next line of gaming GPUs - codenamed Blackwell - which would likely appear in 2024.

Meanwhile, TSMC reported this week that its first-quarter 2023 profits could fall by 5 percent as the company starts to feel the effects of the global economic downturn. Although the chip industry's broad reliance on TSMC helped its fourth-quarter 2022 profits, decreasing consumer demand is expected to impact the Taiwanese giant throughout the later part of 2023, possibly resulting in single-digit declines.

Still, TSMC is hoping for recovery with upcoming product launches like the iPhone 15, which relies on its manufacturing, to provide a boost. TSMC might also cut spending on future expansion plans. Last year, the company reduced projected expansion spending from $44 billion to $36 billion.