Why it matters: Arm owner SoftBank has resorted to floating the company after failing to sell it to Nvidia, but those plans are coming up against a legal fight that started in 2020. It involves Arm's Chinese joint venture.

The Financial Times obtained documents indicating a legal challenge from the head of Arm China, which is jeopardizing the main British company's plans for an initial public offering (IPO). It's is the third such challenge in a nearly two-year battle.

SoftBank is opting for an Arm IPO after regulators blocked it from selling the company to Nvidia for $40 billion last week. However, Investors may have trouble valuing Arm because it has been unable to oust the head of the Chinese division.

In 2020, Arm China's board voted almost unanimously to remove its head, Allen Wu. Wu ignored the vote and maintained control of the company because he is its legal representative and possesses its official seal, which Chinese law requires to enact official documents.

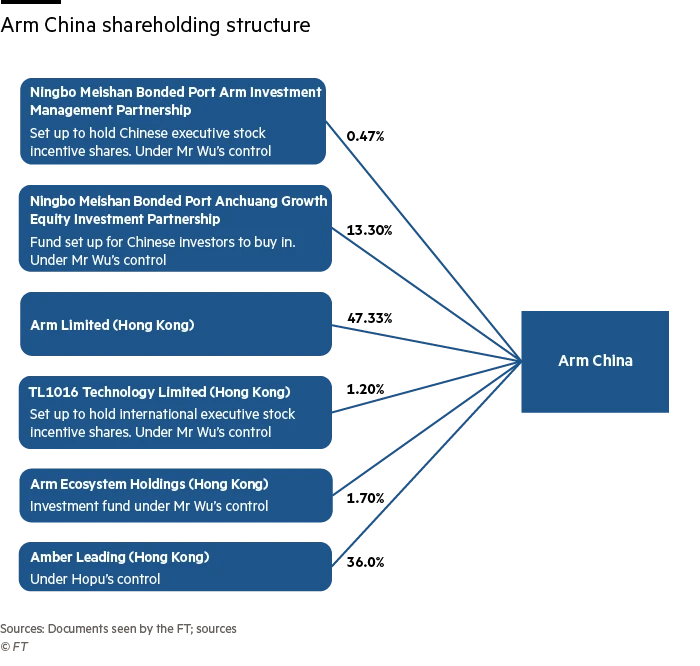

Wu also controls a key investment firm that gives him power over most of Arm China's shareholders. He's using one of those shareholder companies to launch his latest case against Arm China, which is ultimately stopping SoftBank from listing the primary Arm division on New York's Nasdaq exchange.