Why it matters: Last week, Nvidia's $54 billion acquisition of chip manufacturer Arm was expedited by offering concessions to EU regulators. Unfortunately for the GPU titan, that hasn't exactly worked in their favor---its desire to buy the British company hit a stumbling block today as authorities are concerned about how the deal will affect competition in the industry.

Reuters sources revealed that the proposed deal is expected to face an extended EU antitrust investigation due to Nvidia's concessions failing to address competition concerns. A preliminary review conducted by the European Commission should conclude on October 27, followed by a further four-month investigation into the deal, the sources added.

"The regulatory process is confidential. The transaction will help to transform Arm and boost competition and innovation, including in the UK," Nvidia stated.

The competition enforcer for the EU opted not to receive feedback from rivals and customers. Instead, it said the concessions were not sufficient enough to alleviate its concerns. Nvidia declared that it would operate Arm as a neutral technology supplier amid apprehension among customers, including Qualcomm, Samsung Electronics, and Apple.

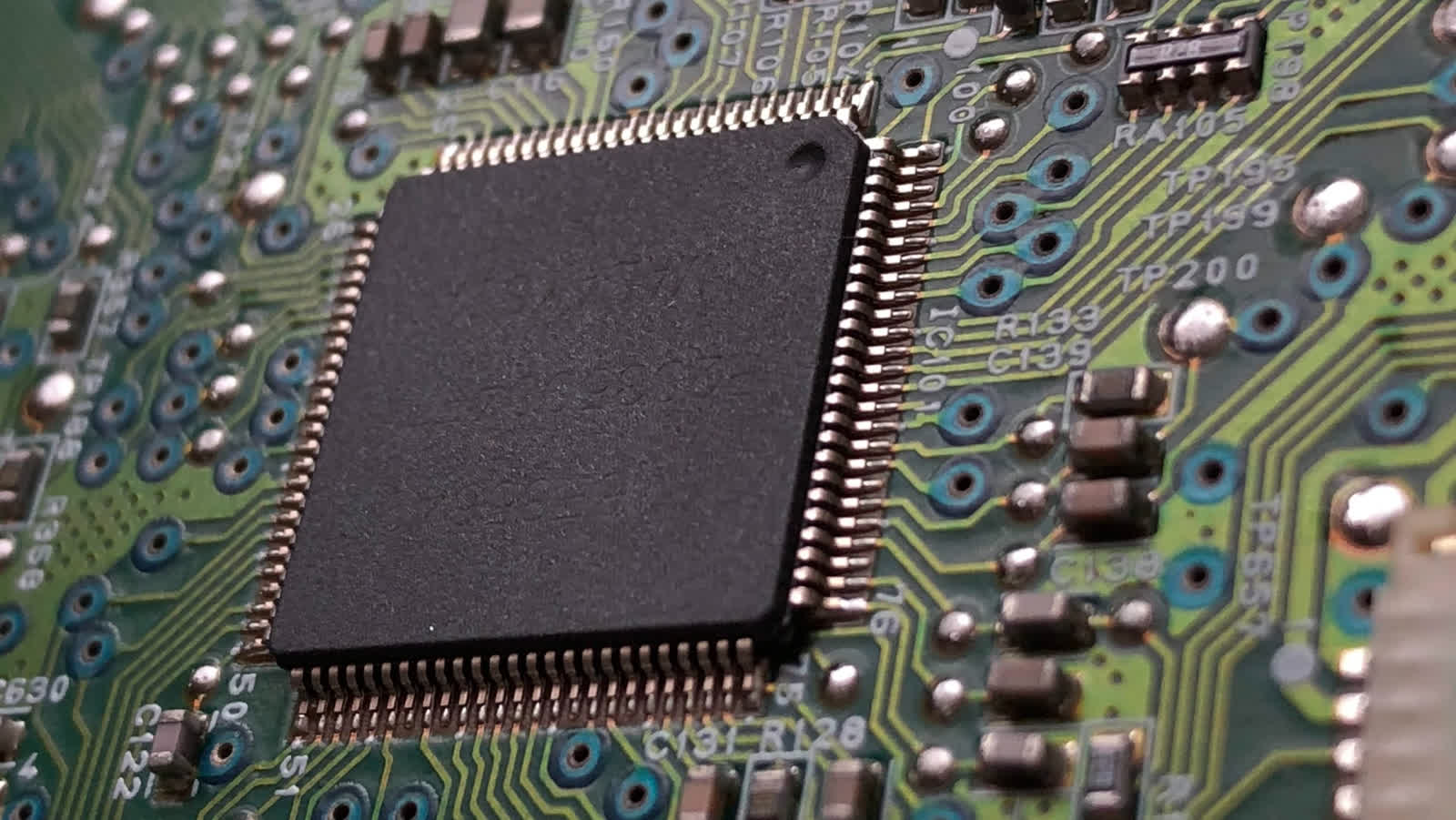

Nvidia is currently the world's biggest manufacturer of graphics chips and is establishing itself as a market leader in the artificial intelligence chips field. It would become a tech behemoth in the industry were it to bring Arm under its control. With this in mind, it offered "behavioral remedies" to the commission, which usually indicates a commitment to take measures at preserving competition.

Arm's co-founder believes if the sale were to be completed, it would be a disaster due to worries surrounding Arm's neutrality. Earlier this year, a UK regulator also weighed in by launching an investigation.

Related reading: Nvidia purchase of Arm completely resets semiconductor landscape

Should the deal ultimately fail to materialize, Arm may consider an IPO---the Cambridge-based firm generates billions in revenue. However, Simon Segars, Arm's chief executive, is "100% focused on closing this transaction." If Segars' ambition to see the sale come to fruition becomes a reality, it will only trail Dell's acquisition of EMC ($64 billion) among the largest tech deals in history.

"The combination of Arm and Nvidia is a better outcome than an IPO," Segars stressed. "The level of investment that will be needed to lead in artificial intelligence will be unprecedented."

Meanwhile, while Nvidia awaits the outcome of the investigation, it has teamed up with Microsoft to create the largest and most powerful language model to date, based on training an AI model on a supercomputer.