In context: Video conferencing app maker Zoom has experienced exponential growth in the last few months. In December, the company had 10 million daily active users. By February, the count had ballooned to 200 million. As of March, Zoom has eclipsed all competition with over 300 million daily active users.

Update (4/30/20): Amazon Web Services (AWS) reached out to TechSpot to inform us that it has been and continues to provide cloud infrastructure services to Zoom. The Oracle contract was for additional support. In fact, Oracle joins both AWS and Microsoft Azure in delivering cloud infrastructure for the company.

Zoom's Chief Technology Officer Brendan Ittelson provided a statement [edited for length].

Zoom, we use a mix of cloud technologies and our own data centers to help deliver the service and ensure that our customers are able to collaborate. So we do use services such as AWS, the Oracle cloud infrastructure, and Azure, as well as our global data center network of co-locations that we manage. Prior to this crisis we, by and large, used our own data centers for all the real-time traffic, and our pre-meeting and post-meeting later on AWS. Our real-time traffic always stayed inside our own data centers for our paid customers. During this pandemic crisis every day is a new record --- our own existing data centers really cannot handle this traffic. Several months ago, Amazon really offered great support to us. [AWS] offered tons of server size, and every night added 5,000 to 6,000 servers --- a lot of servers to help us worldwide.

Ittelson indicated that as one of its customers, Oracle already had a working relationship with Zoom and offered to help. After testing the service, Zoom was pleased with the results, so it officially added Oracle as another cloud infrastructure provider.

We apologize for any confusion in the original reporting.

Zoom experienced a surge of scale for which it was not prepared, as evidenced by security issues that came with the enormous customer base. This growth also put tremendous pressure on its cloud infrastructure. It was unable to deal with its growing numbers alone. It needed a cloud service provider, and it got one.

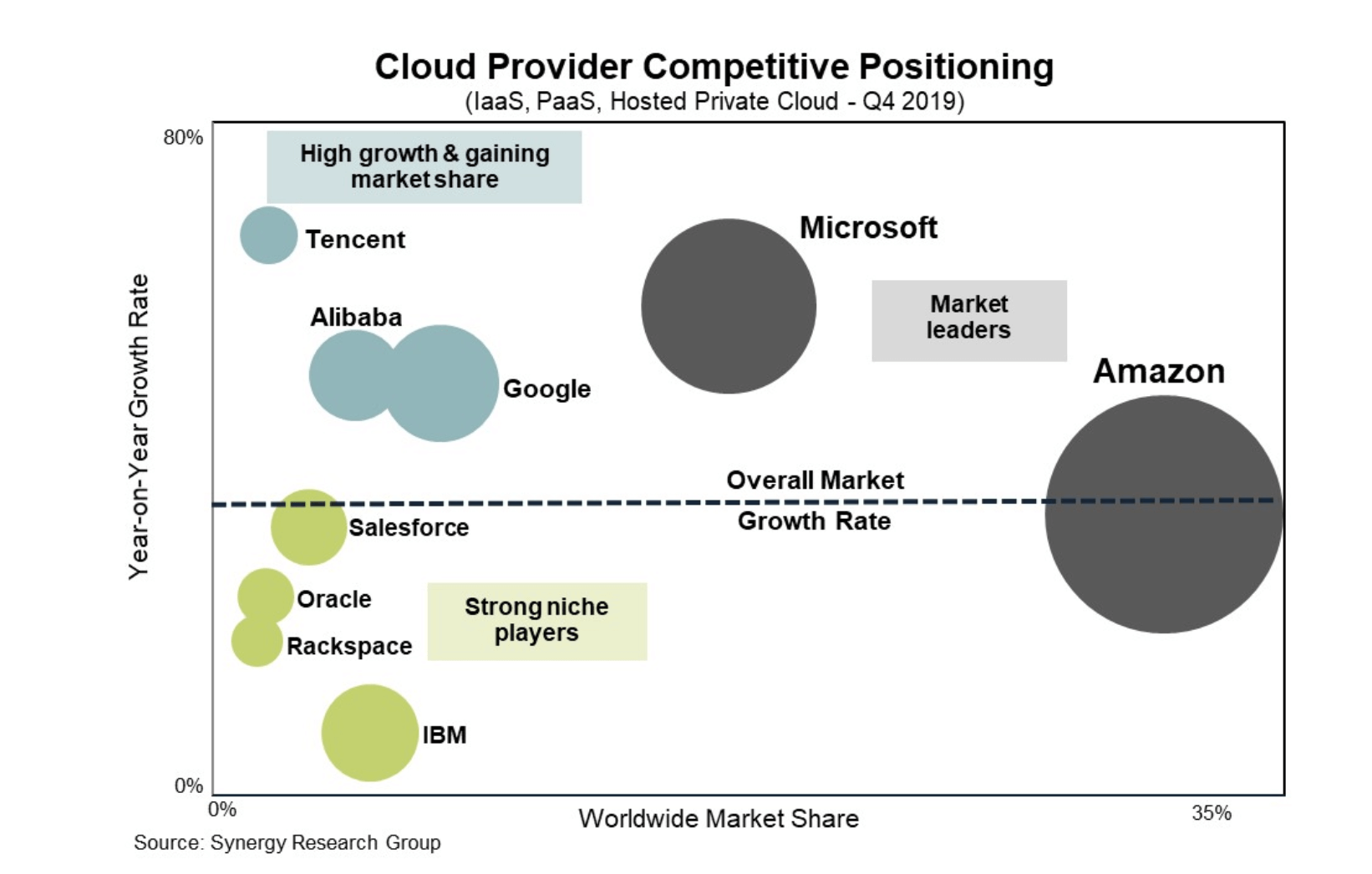

Surprisingly, Zoom chose Oracle to help bolster its cloud-based needs. According to a February Synergy Research survey, Oracle is a "strong niche player" in the cloud provider market, but is far behind industry leaders Amazon, Microsoft, and Google. So it is somewhat unexpected that Zoom did not partner with a more prominent player. The move has analysts speculating the rationale for the move.

"I think Zoom went with Oracle because they are proven in the enterprise in terms of mission-critical apps built on Oracle databases running on Oracle hardware in the cloud," CRM Essentials analyst Brent Leary told TechCrunch. "Zoom needs to prove to enterprises that they are able to handle scale and data security needed to beyond what SMBs typically require."

There is also the possibility that Oracle outbid everyone else just to get telecommuting's fastest-growing superstar under its belt or that Zoom did not go with a potential rival. Amazon, Google, and Microsoft all have competing products, so it might make some sense not to have your competitor provide the infrastructure of your business. It's a pretty clear conflict of interest.

The partnership was foreshadowed somewhat by compliments Oracle's chairman Larry Ellison paid the company in a video earlier this month. Zoom has been Oracle's go-to video conferencing app during the economic shutdown, and he indicated the company would continue using Zoom even after returning to normal business operations.

"Zoom has become an essential service for Oracle," said Ellison. "The way we work will never again be the same. We will now meet, not just face-to-face --- we'll meet sometimes face-to-face and sometimes digitally via Zoom."

So maybe Zoom was simply flattered by the compliment. Regardless, despite being a smaller provider in the industry, Oracle should relieve some of the pressure that Zoom has been feeling since going from bit player to top dog in the telecommuting market in the span of just over three months.

To put it in perspective, Microsoft bragged last November about holding the lion's share of the market with 20 million active daily users. It now has 44 million. Zoom came along and said, "Oh yeah. Hold my beer."