What just happened? Market intelligence firm TrendForce recently took a look at the global high-tech industry to gauge the impact of the COVID-19 outbreak, otherwise known as the coronavirus.

The semiconductor sector has a higher degree of automation than some other industries so the impact on that front isn't as severe as elsewhere. Unfortunately for fab operators, many employees come from out of town and with traffic and labor restrictions in place, fab utilization could be impacted. As a result, TrendForce said it is forecasting a possible decline in shipments for the Chinese foundry industry in the first quarter that could have an impact downstream.

IC design shouldn't be impacted due to the fact that many now work remotely and collaborate via the cloud.

DRAM and NAND flash production isn't expected to take much of a hit, either. Companies stocked up on supplies ahead of the Chinese New Year and assuming that materials can continue to be imported as usual, the outbreak presents no real problem here.

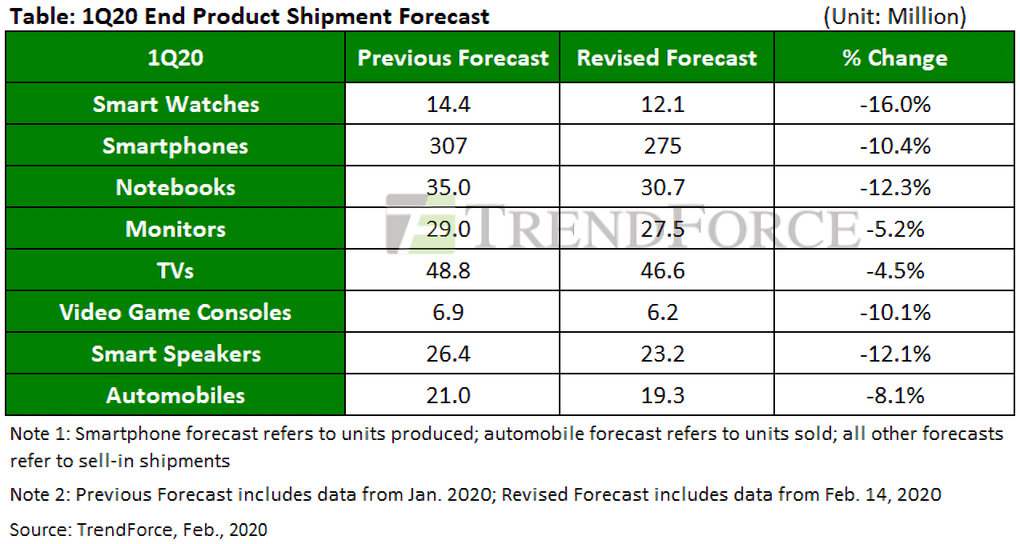

The situation is a bit fuzzier in the display industry. Panel makers are maintaining maximum water input for front-end displays, TrendForce said, but back-end module houses, downstream brands and original design manufacturers face issues arising from labor shortages and transportation limitations. As such, TV set shipments are expected to fall from a previous prediction of 48.8 million units in the quarter to 46.6 million units. Similarly, monitor shipments are forecasted to drop from an expected 29 million down to 27.5 million units.

One area that is being hit the hardest is the consumer smartphone industry due to the fact that the supply chain is highly labor-intensive. TrendForce said production during the quarter is expected to decline by 12 percent year-over-year, making it the quarter with the lowest output over the last five years. If the outbreak isn't contained by the end of February, it is likely that smartphone production will continue to be negatively affected into Q2.

Game console manufacturers have seemingly caught a break, at least thus far. The busy season for consoles is Q4. Thus, Q1 is a weak season as the peak season for the supply chain won't happen until 2H20. If the outbreak can be contained before the end of March, the industry should be able to make up for any losses happening right now.

The timing arguably couldn't be better for Sony and Microsoft. Sales of their respective consoles have tapered off in recent months due to anticipation for next-gen systems scheduled to launch in the fourth quarter of this year. Had the virus outbreak hit at any other time, or especially just after a new console launch, the impact could have been far greater.

Masthead credit: Microchip by Gorodenkoff. Shipping yard by Mr. Amarin Jitnathum.