Bottom line: Spotify is having a great year and its strategy is paving the way to profitability, even if it's not quite there yet. If it can sustain the current growth rate, it stands a good chance to become more financially stable and possibly an upper hand in contract negotiations with content owners who've earned over $14.5 billion since the streaming service launched.

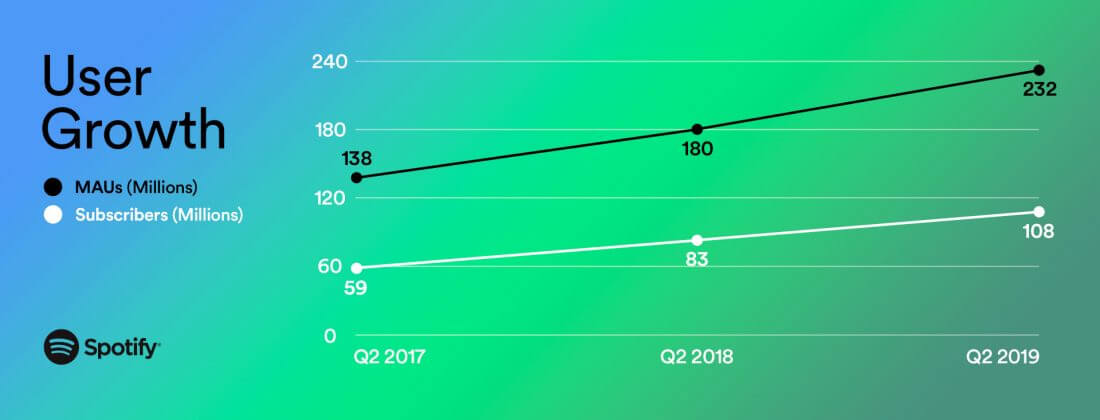

Spotify's numbers for the second quarter of 2019 are in, and it looks like the paying userbase now stands at a strong 108 million, an impressive result that is downplayed by less than stellar results on the business side. The company fell a bit short of its estimates that it would add 8.5 million subscribers by the end of June, but it is a 31% year on year growth.

To give you an idea of how that compares to the competition, Apple Music has 60 million subscribers if you go by their last reported numbers. Something worth noting is that new Spotify subscribers had the option to take an offer of $0.99 per month for three months if they signed up between May and June.

Couple that with family deals and student discounts (also available on Apple's Music service) and you get an average revenue per user (ARPU) of $5.42 against a normal full price of $9.99/month. This is also explained by Spotify's total number of users which is hovering at around 232 million active every month, a 29% increase over last year and definitely one of the more positive highlights in the financial report.

All of this means Spotify's bets are starting to pay off. The company recently opened up a window for users in emerging markets with Spotify Lite, a stripped down version of the app that works on lower end devices and uses less data.

More important is the company's decision to expand into podcasts, with expensive but inspired acquisitions like Gimlet Media, Parcast and Anchor. Spotify also signed up an exclusive deal with Barack and Michelle Obama's Higher Ground Audio, and made some touches to its app to bring podcasting into focus. This resulted in a 50% increase in active podcast listeners since the last quarter.

On the business side, the company made about $1.7 billion (€1.5 billion) in revenue but would have needed at least $3.3 million to break even and not lose money this last quarter. Still, the company has reasons to be optimistic about the future, provided it keeps busy diversifying its content selection.

Meanwhile, competitors are making their moves to grab more users. Apple is looking into ways it can evolve its Podcasts app into a full-blown subscription service with exclusive content. Amazon Music is also coming into focus as a trojan horse competitor – growing faster than both Spotify and Apple Music, mostly thanks to a young and price-sensitive audience.