Why it matters: The energy consumed to mine cryptocurrency is as much debated as it being an alternative to conventional currencies. A study conducted by researchers in the University of Cambridge reveals that Bitcoin, which is one type of cryptocurrency, uses as much energy as the whole of Switzerland. The tool they have developed to estimate the figure also shows that the annual electricity consumption of the Bitcoin network would be enough to satisfy the university's own energy needs for another 365 years.

The University of Cambridge launched an online tool this week: Cambridge Bitcoin Electricity Consumption Index (CBECI), which estimates in real-time, energy needed to maintain the Bitcoin network and outputs its annual consumption using this data.

"The index has been developed in response to growing concerns over the sustainability and environmental impact of Bitcoin mining, which relies on computation-heavy cryptographic operations that require significant amounts of electricity. Reliable estimates of Bitcoin's electricity usage are rare: in most cases, they only provide a one-time snapshot and the numbers often show substantial discrepancies from one model to another," the university notes in its announcement of the CBECI.

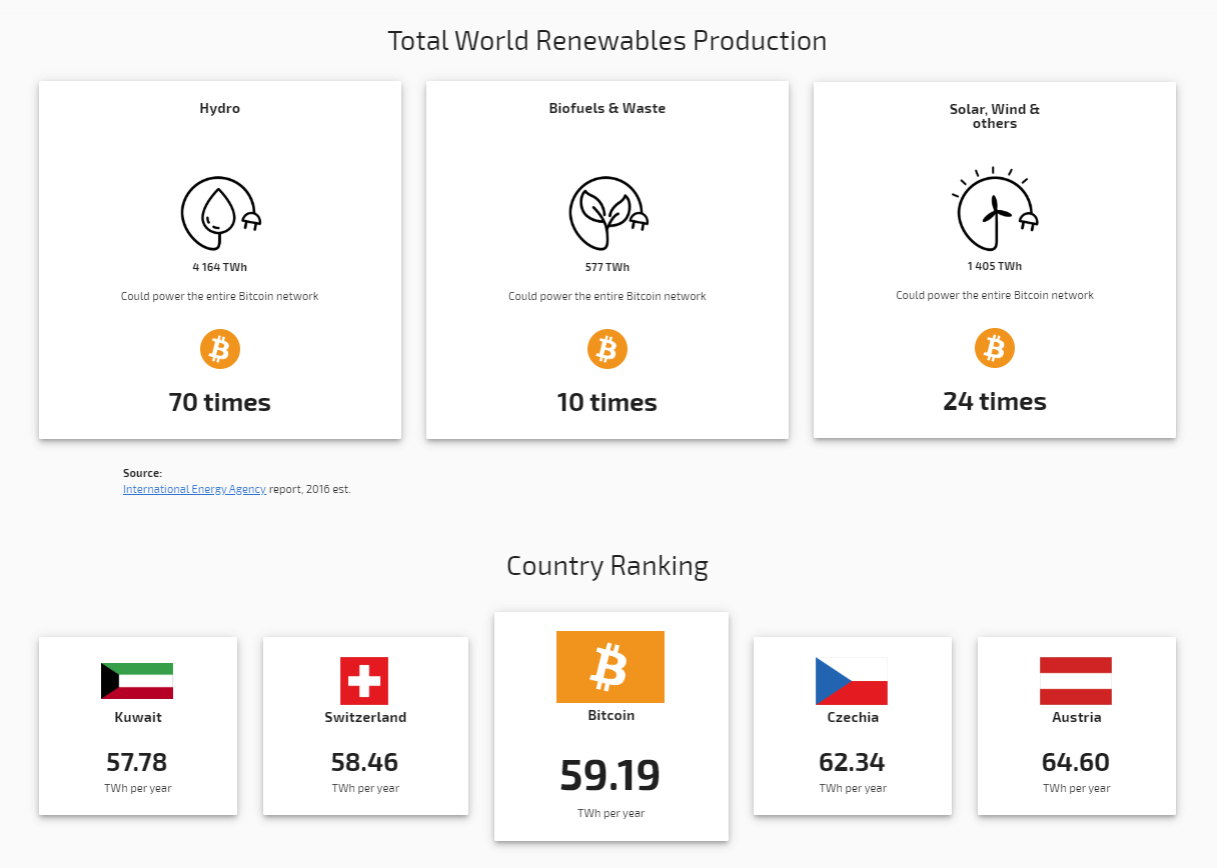

At present, the Bitcoin network is found to be using around 7 gigawatts of electricity that approximates to 0.21% of the world's supply. It updates the estimate in 30 second intervals and uses an average electricity price per kilowatt hour ($0.05, £0.04) while assuming various efficiency values for Bitcoin mining machines worldwide. A lower and upper bound value (refreshed in real-time) is displayed alongside the estimated figure resulting in a rather wide spread. Currently a 2.66 lower bound and 21.58 upper bound value suggests that the estimate of 7.11 gigawatts should be taken with a pinch of salt.

"We want to use comparisons that set the narrative," said Michel Rauchs, the tool's co-creator, adding that visitors to the website can "make up their own mind" as to whether the figures seem large or small.

To come up with the annual estimate, the tool assumes constant power usage over the period of one year. It also applies a 7-day moving average to this figure to "smoothen the impact of short-term hashrate volatility and enable better comparisons with other uses of electricity."

According to the University of Cambridge, the tool has been designed as a "first step toward a more comprehensive analysis of the environmental footprint of the cryptocurrency mining industry," with an interactive geographical map of global mining facilities to be added in the second phase that will "explore the energy sources used and provide a more accurate assessment of Bitcoin's total carbon emissions."