Bottom line: Corning is one of the few companies in the mobile industry that is currently exceeding revenue expectations. Lower smartphone sales are impacting Gorilla Glass sales as well, but 5G is driving growth very quickly.

Many signs are pointing to smartphone makers struggling to maintain increasing sales trends. Apple is having a very hard time selling iPhones because of their price, cultural issues in China, and consumers being more informed about battery upgrades. Samsung has lowered its expectations for quarterly revenue. Even throughout these more difficult times for smartphone makers, Corning is an unlikely supplier that is doing very well.

Best known for being the maker of Gorilla Glass, Corning has been able to exceed expectations causing shares to rise more than five percent. Within the specialty materials unit responsible for Gorilla Glass that is used nearly ubiquitously on smartphones and tablets, sales rose by 2 percent to $399 million.

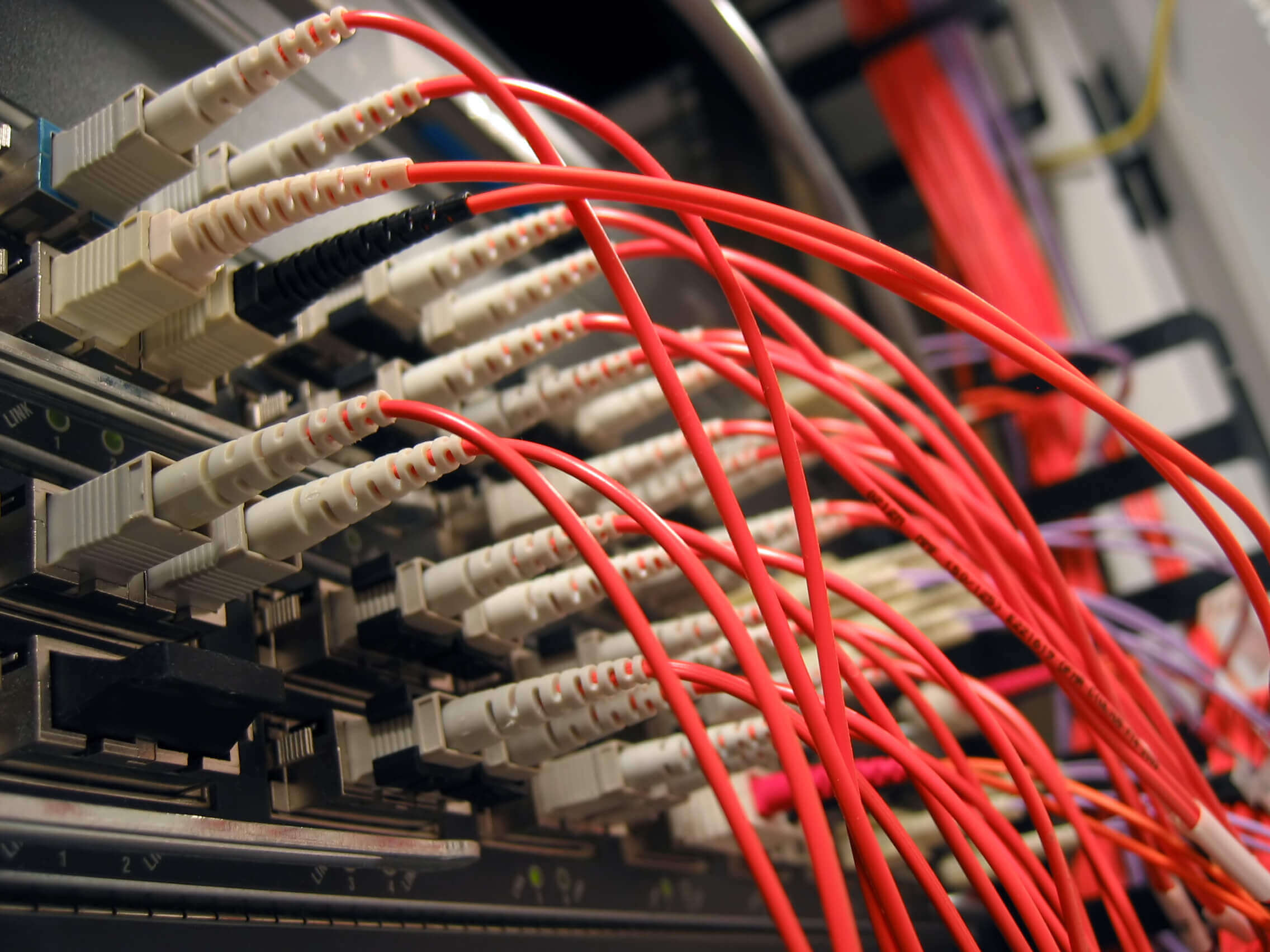

Corning's success during hard times is no secret though. Diversification has allowed the company's optical communications division to be the star performer this past quarter. Sales of networking equipment for 5G has caused massive growth of 26 percent, accounting for $1.17 billion in revenue.

As the 5G rollout continues domestically and abroad, Corning is on track to break $5 billion in sales by the end of 2020. Given that Huawei is in some pretty hot water with the United States, Corning has to compete with one less company.

Compared to one year earlier, Corning posted a loss of $1.41 billion. This year things are a lot better, with a net income of $292 million.