A hot potato: Nvidia has become the dominant force in the AI hardware industry, and CEO Jensen Huang knows it. The leather jacket-loving boss is so confident in the ability of his products, he says that even if the competitors' chips were free, they would still be a worse option than Nvidia's expensive alternatives.

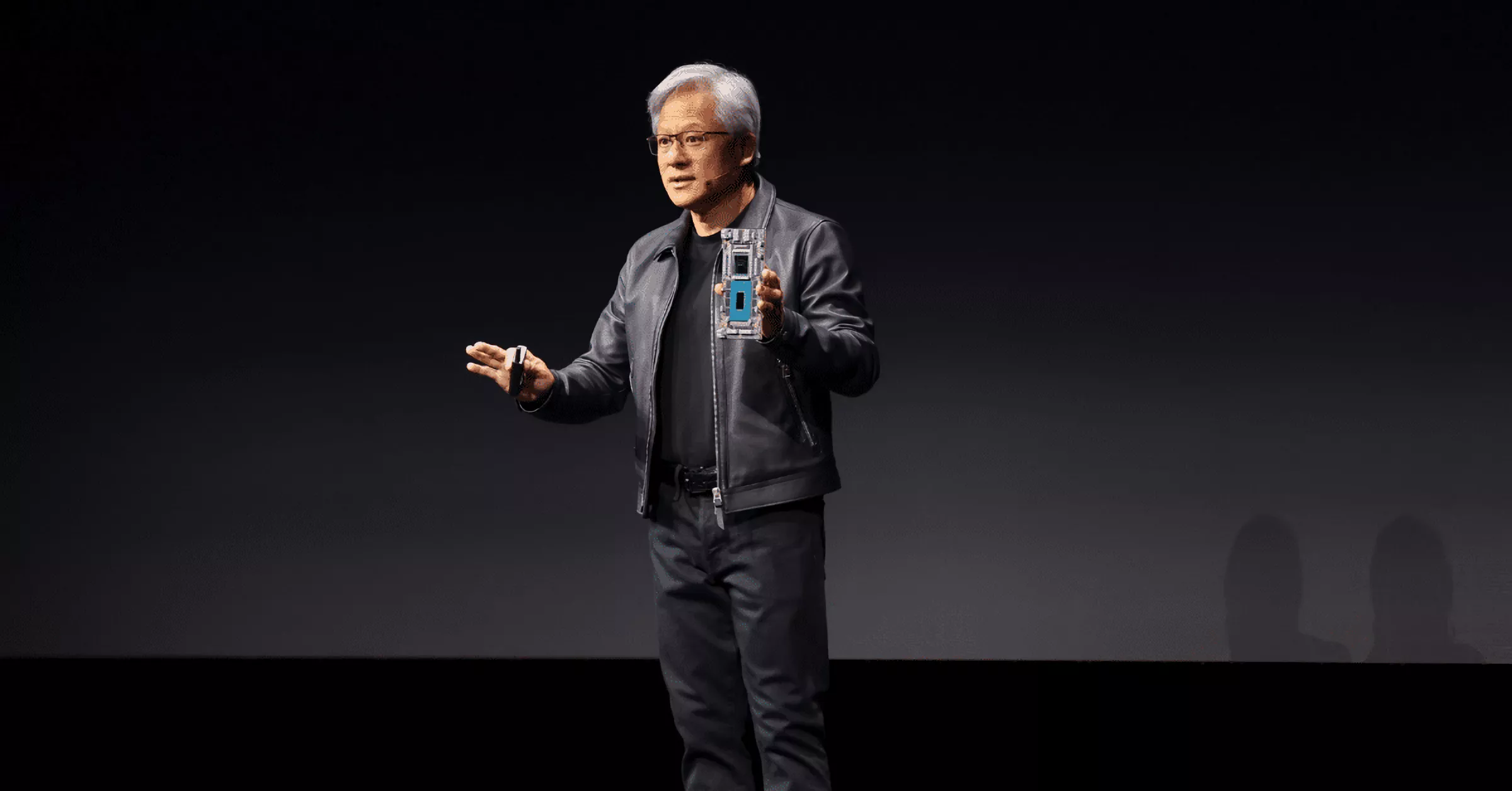

Speaking during a keynote at the 2024 SIEPR Economic Summit, Huang was asked by John Shoven, the Charles R. Schwab Professor Emeritus of Economics at Stanford University, about the prospect of rivals that could offer competing chips that were "good enough" to replace Nvidia's and at a much cheaper price.

Huang started his answer by complaining that Nvidia has more competition than anyone on the planet, having to deal not only with direct competitors but also customers who buy its AI products in order to design competing versions. He also said that Nvidia shows these customers the current and future designs of its chips, partly due to Nvidia's completely "open-book" policy that sees it working with almost everyone in the industry.

Huang's claim of openness and working with competitors will likely raise some eyebrows. According to a report from last month, hardware startup Groq, which creates AI chips for LLM inference, said Nvidia customers have to be secretive about acquiring or ordering AI acceleration tech from rival firms in case Nvidia decides to delay their orders as punishment. Former AMD vice president Scott Herkelman, who previously worked for Team Green, said "They [Nvidia] are the GPU cartel, and they control all supply."

Speaking about the price of Nvidia's AI accelerators and whether competitors' alternatives would offer better value for money, Huang said it's only those who buy and sell chips that think about the prices, while those who operate data centers think about the cost of operations.

The CEO added that Nvidia's chips exhibit an excellent Total Cost of Ownership (TCO) – a measure of both direct and indirect costs – thanks to factors such as time to deployment, performance, utilization, and flexibility. The TCO is so impressive, Huang claims, that even if competitors were giving their chips away for free, it wouldn't be cheap enough.

Although plenty will argue with Huang's claims of Nvidia's benevolence, it's easy to see where his hubris comes from. Nvidia is now the third-most valuable company in the world by market cap ($2.19 trillion) and could soon replace Apple in second position, all thanks to its dominance of the advanced AI hardware market. It's also propelled Huang to the 20th position on Bloomberg's Billionaires Index – his fortune now stands at $77.2 billion.