In context: Despite a few setbacks over the years, Tesla is now doing quite well for itself. In 2019, it managed to ship an impressive (by Tesla standards) 367,500 vehicles, and it's rapidly opening up new "gigafactories" throughout the world. If that wasn't enough for the electric carmaker, though, there's more good news for it to boast about now.

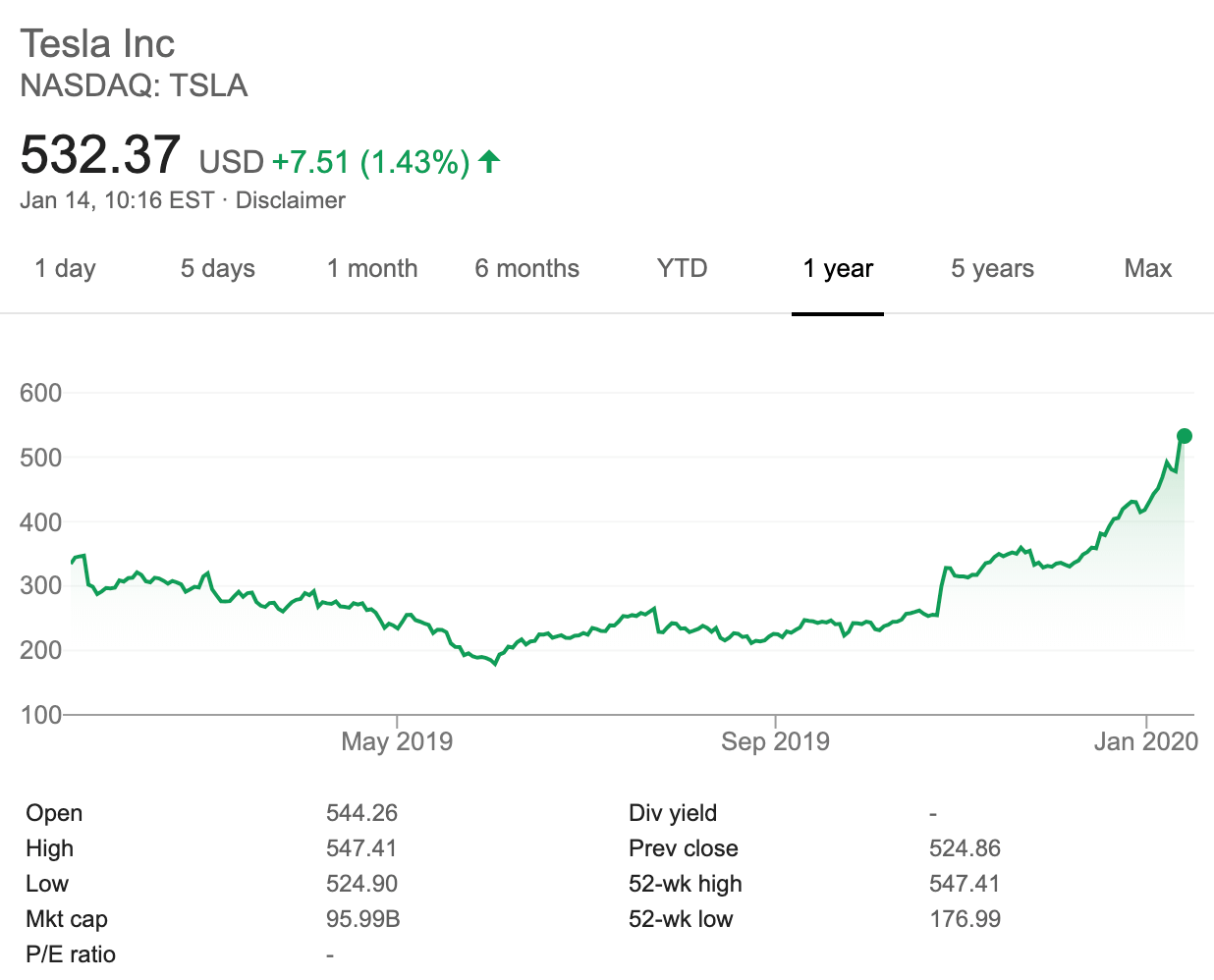

Yesterday, Tesla's stock surpassed $500 per share, which has pushed the EV maker's total valuation to roughly $94.6 billion as of writing. That's an astounding figure for such a comparatively small car company and one that Tesla is probably pretty pleased with. Notably, it also makes Tesla America's most valuable car company (for now).

The $94.6 billion number is made even more impressive when it's put into the appropriate context. As other outlets have noted, Tesla's total valuation is higher than not just that of other carmakers, but also the combined value of some such companies – Ford and GM, for example. The two automotive giants are, as of now, worth $36.64 billion and $50 billion, respectively.

Of course, as great as this news will be for Tesla's executives and stockholders, there's no guarantee this rapid stock price growth will be sustainable in the long term. Tesla has seen quite a bit of success and stability over the past few months in particular, but the company's past is still troubled, especially where production is concerned. We'll have to wait and see whether those troubles will rear their heads again in the future.

For now, though, Tesla (and anyone who's purchased its stock) gets to enjoy the fruit of its labor. For our part, we look forward to seeing how Tesla's stock performs over the next few months. Will it rise further and take the company beyond the $100 million ceiling or will it fall back down to earth? Only time will tell.