Forward-looking: Monzo, the UK's digital-only bank that already boasts over 2 million customers since launching in 2015, is making its way to the US in the "next few months."

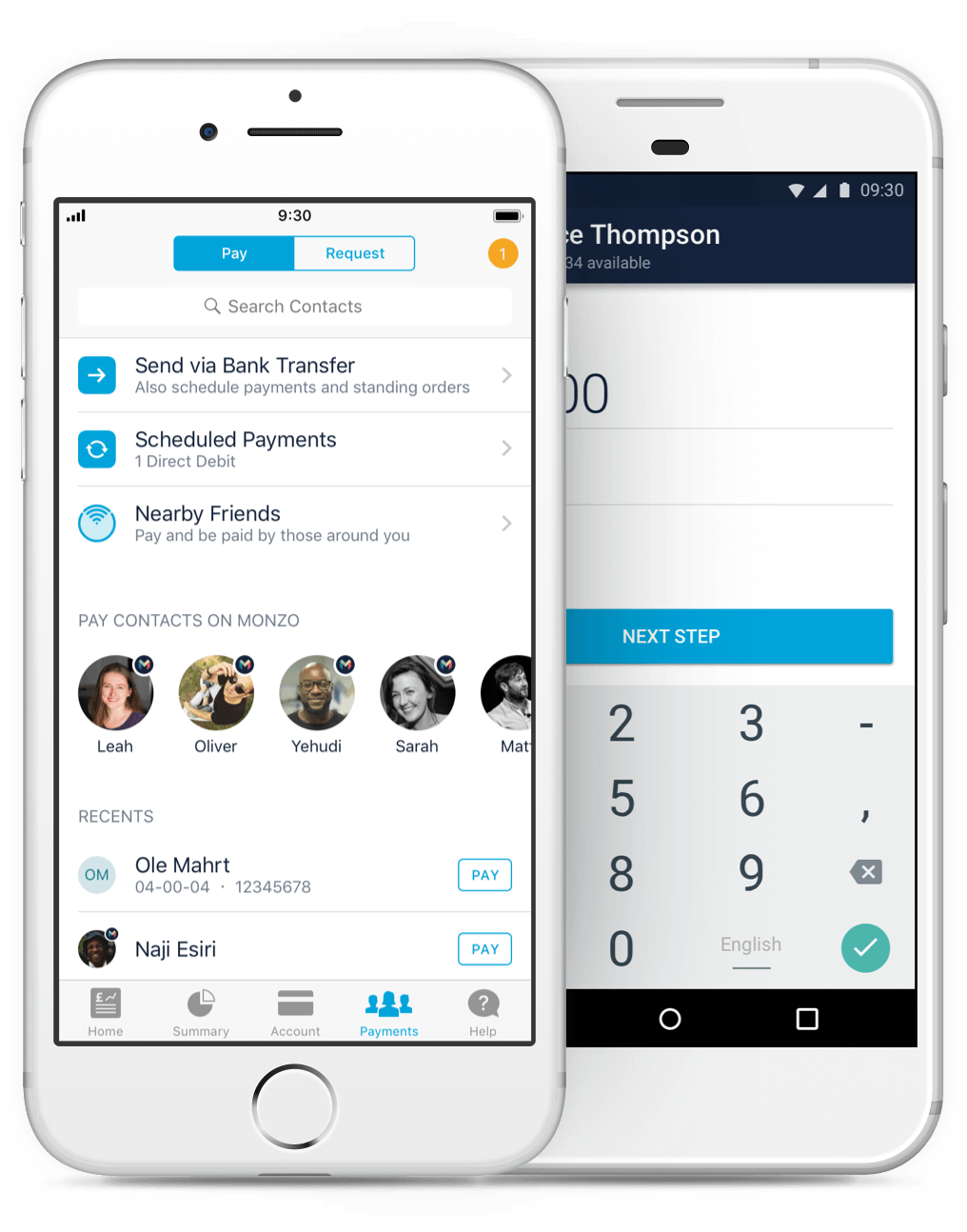

Monzo says it's the UK's fastest growing bank, with 40,000 people opening an account every week. The company has no physical locations, so everything takes place using the Android or iOS app. It offers benefits including instant spending notifications, no fees when spending cash abroad, person-to-person payments using a phone, and "pots" for splitting savings from spending money.

As it did when it launched in the UK, Monzo will be offering its debit card and mobile app to US users at in-person events in major cities, "a few hundred people at a time."

The firm isn't a fully licensed bank in the US yet. As that's a lengthy process, it's working with a partner bank (Ohio-based Sutton Bank) to serve American users sooner. The partnership ensures customers' money will be fully FDIC-insured.

With the promise of no hidden fees or charges and the absence of endless paper forms, it's easy to see the appeal of digital-only banks such as Monzo, though some people still feel uncomfortable putting their money into organizations that have no traditional brick-and-mortar locations. Monzo will also have to deal with more complex banking regulation in the US compared to the UK.

If you're interested in attending one of Monzo's upcoming US events, you can join the waitlist to be informed when the next one is happening.